ATTENTION:

The Federal Trade Commission has Launched a Civil Action Against The Reserve

- I am no longer affiliated with The Reserve.

- This link goes to an article I wrote to provide more details on the current state of affairs at The Reserve.

- I do not have any properties available to sell. I am now working to recoup the $1.4 million I contributed to an LLC that was supposed to develop land in Costa Rica. As a result of the FTC Action against the developers at The Reserve, the Costa Rica project will not move forward.

- The FTC Action is published at this link.

- I am creating a chronology of events that I will publish on the FTC Website, and on this website. But I cannot publish those documents until counsel advises me to do so.

- I am keeping the information below available for historical purposes—but as of November 7, 2018, it is no longer valid.

- This update is current as of November 13, 2018.

Choose Three Options to Invest Overseas!

- If you have

capital to invest, learn how you can earn a higher rate of return. - If you want to own real estate with

no-money down , learn how I can make that happen by reading below!

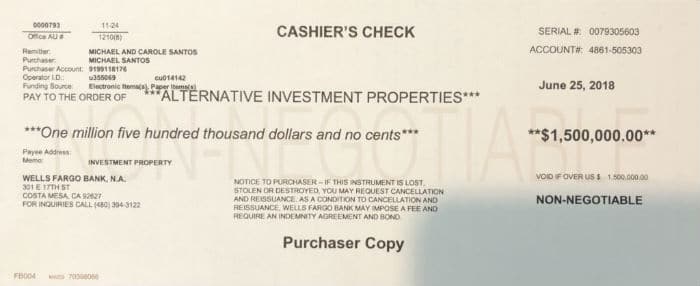

As you can see from the image of the cashier’s check on the

With those funds, I invested with the same development team that created the award-winning, master-planned community known as The Reserve, in Southern Belize. Newport Land Group, LLC has other ongoing projects in The Bahamas, the Dominican Republic, Cabo San Lucas, and Costa Rica.

I leveraged my anticipated returns on the investment I made with the development team to acquire 27 home sites in a pre-construction section of Laguna Palms, one of 12 subdivisions at The Reserve.

Since I own the land, and my investment guarantees payment to the developer, I am able to finance people who want to use leverage to own an appreciating asset, in an appreciating market.

Should you want to take action and start investing, your terms on the property follow:

- Lot Size: Approximately one-half acre lot size (.4 acres)

- Sale Price: $135,000

- Interest Rate: 3%

- Monthly Payment: $550 and up, depending on loan term.

See my financial reports to get an idea

If you want more information on the investment in Belize, click the boxes below to see my responses to frequently asked questions. And if you want to take action, connect with me today!

1. Why I Invested in Belize

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

I’m super excited to have invested in Belize and I’d like you to know why. Although I wrote a lengthier article where I described the entire

• Why I Invested in Belize (And Maybe You Should, Too!)

I invested at The Reserve because I perceived a great opportunity. As soon as I saw the beauty of The Reserve, I could see the future.

The developer had invested tens of millions of dollars to build amenities like a 250-slip deep-water marina, an extraordinary beach club, an equestrian center, organic gardens, and several restaurants. The team also developed a private island that belonged to all of the owners at The Reserve. More than 1,000 people had already purchased home sites on the property, and many of those owners were cumulatively investing tens of millions of dollars to develop their homes in paradise.

With all of that investment going into The Reserve, I saw

When I first visited the property, I intended to purchase a home site, build a house, and use the house as an income-generating property. It would be an amazing experience for people who wanted to have a non-touristy experience in an exquisitely beautiful property. My research suggested that I could generate about $300 per day in income from the investment. If guests occupied the property for 70 percent of the year, the property would generate between $6,000 and $7,000 per month on

I anticipated the entire project would require about $500,000 in

For those reasons, investing in Belize made all of the sense in the world to me!

In summary, I invested in Belize for the following reasons:

1. I wanted to avoid stock-market volatility.

2. I wanted to get a great income from my investment, which would be far better than the bond market could provide.

3. I wanted to move some assets outside of the United States to minimize exposure to the crisis that could follow with the growing U.S. debt obligations.

4. I wanted to prepare for retirement by owning property in a beautiful piece of paradise that my wife and I could also enjoy.

5. I wanted to make more money from my investment than I could earn elsewhere.

All in all, I expected that the $500,000 investment would turn into more than $1,000,000. And I anticipated that—over time—my tenants would pay for the property.

That is the reason I invested in Belize. Perhaps it’s a reason for you to invest, too.

As you’ll read elsewhere, after my initial thoughts, I invested much more in Belize. I’m convinced that there is

2. Why You Should Consider Investing In Belize

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

There are a lot of reasons why you should consider investing in Belize. Recently I made that case to my two sisters. If you’d like to read that article, you can find it by clicking the following link:

Here are some bullet point reasons why I think you and others should think about investing in Belize, or in other foreign markets.

The United States is a great place to live, but it’s not the only place. Many baby boomers want to retire in paradise—particularly if they can move to paradise at a lower cost of living. Every day, more than 10,000 Americans retire. Those growing numbers of retirees will consider spending their golden years in oceanfront communities of Belize.

As an investor, I encourage you and others to consider Belize as an alternative investment. Over the next 20 years, I anticipate market prices to rise for real estate in Belize.

Investors who have concerns about the stock market volatility and risks to their portfolio may consider as an alternative. Real estate in oceanfront communities like The Reserve

Further, since 1,000 people have purchased home sites at The Reserve, there is real market confirmation. Those owners will build their dream houses on the property, bringing hundreds of millions of dollars into the community. That cumulative investment of more than $1 billion gives me a lot of confidence that it makes a lot of sense to buy properties now—in anticipation of those rising valuations.

I like the fact that the properties have a great chance of rising in value, and a low chance of falling in value. From my perspective, investing in Belize makes more sense as a solid retirement plan than investing in the US.

For the reasons above, I think you should consider joining me by investing in Belize—especially since you can own property at The Reserve with

3. How I Negotiated My Investment In Belize

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

If you’re interested in a case study showing how to acquire real estate with

Here is the short story.

in early 2018, I realized that I needed to change my investment strategy to prepare for retirement. Markets are always changing. When markets change, investors need to take action.

I traveled to Belize to visit The Reserve, a beautiful 14,000-acre, master-planned community. While there, I began making calculations on how an investment would work out.

The more research I completed on the development, the more my confidence grew. Instead of investing my cash into the Belize development, I made a commitment to invest $1.4 million with the developer in a new project in Costa Rica. That new project gave me equity in the Costa Rican project. It also helped me to build a relationship with the developer.

Since the developer and I opened a long-term relationship with the development in Costa Rica, I was in a great position to leverage the investment. I pledged my equity in Costa Rica to acquire 27 home sites in Belize.

The contract I have with the developer allows

Readers who want more details should check out the lengthier article by clicking the following link:

4. How I Can Sell Home Sites For No Money Down

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

I own home sites in the beautiful, oceanfront, master-planned community of Belize known as The Reserve. If you haven’t seen videos or photographs of this community before, you can find many videos through my YouTube Channel:

- Michael Santos YouTube Channel (As an aside, I have several YouTube channels to profile my other businesses, so make sure you check out the link I provide to access videos of The Reserve.)

Earlier, in a separate article, I wrote how I negotiated my acquisition of 27 home sites in Belize. If you read that article, you can learn more about why I can offer no-money-down financing terms for others who want to invest.

The short answer is that I invested $1.4 million with the developer of The Reserve, an oceanfront community in Belize. Over the next 20 years, the developer and I anticipate that the $1.4 million I invested will generate more than $7 million in total investment proceeds. Since we expect the developer to distribute those investment proceeds over time, the developer agreed to let me tap into my equity to make another acquisition. I used my equity to acquire the 27 home sites in Belize and the terms of my acquisition allow me to assign those lots to others.

Since my equity with the developer guarantees payment, I am able to sell the home sites at terms that I choose. I am now selling those home sites for no-money down, with a purchase price of $135,000.

Over time, as the developer invests more money to develop the Laguna Palms subdivision at The Reserve (where I acquired my property) I will raise the selling price. For now, I am selling the lots with awesome financing terms as follows:

- Purchase price: $135,000

- Down payment:

No-down payment - Interest rate: 3%

- Monthly payment: Approximately $600 per month, or higher depending on the length of term financed

5. Financing Terms To Invest In Belize

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

In an earlier article, I wrote about how I negotiated my investment in Belize. If you want to learn more about that acquisition, click the following link:

The short answer is that my investment in Belize results from a $1.4 million equity investment I made with the developer in another project. I leveraged that investment to acquire 27 home sites at The Reserve, an oceanfront community in the Stann Creek district of Southern Belize.

I am selling 25 of those home sites for the following terms:

- Approximate size of each lot: .4 acres in the Laguna Palms Subdivision of The Reserve

- The lots I Purchased: Numbers 560 through 584

- Selling Price: $135,000 for each lot

- Down Payment required:

No-Money Down - Interest Rate: 3%

-

Term of Loan: Up to 35 years - Approximate monthly payment: $575 and up, depending on

term of loan requested

I’m offering my top-seven reasons why investing in a

- Americans protect themselves by diversifying their portfolio of assets, with some assets being held outside of the United States.

- Investors can purchase the home sites without having to tie up capital for a down payment.

- Investors are purchasing the home sites at pre-construction prices-meaning they’re acquiring the asset at a discounted price to what the developer will sell the lot later, after completion of the subdivision.

- By 2023, the developer will invest more than $15 million to build a man-made lake, a new beach club, and more infrastructure to service 500+ home sites in the Laguna Palms subdivision-which will boost the value of all home sites.

- By 2023, I anticipate that other buyers will build at least 50 homes in the Laguna Palms subdivision, bringing an additional $10 million+ in capital improvements to Laguna Palms, boosting the value of the home sites further.

- The developer projects that fair-market value for home sites in Laguna Palms will be more than $250,000 each after installation of the new beach club and lagoon.

- By 2023, owners of home sites in other subdivisions at The Reserve will cumulatively invest more than $40 million as they build more than 200 homes-boosting the value of all property at The Reserve.

Investors who want to own appreciating assets, in appreciating markets, should look at Laguna Palms at The Reserve and see if it makes sense for them to acquire one or more of these assets at the amazing terms I list above.

6. How To Manage Property At The Reserve In Belize For Income

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

If you’re living in the United States, you may have some misperceptions about owning an income-generating property in another country. I’m convinced that it’s going to be easier than ever. My wife and I are taking a step-by-step approach.

I’ll share the approach with hopes that it will help you and others understand our investment strategy.

If you’ve reviewed some of my earlier posts, you know a little about how I acquired my property in Belize. If not, check out the article at the following link:

That article explains how I leveraged an investment I made in Costa Rica to acquire 27 lots in Belize. My wife and I are in our mid-50s and our intention is to sell 25 of the lots and build houses on two of the lots. We’ll use those two houses to generate income. That income will help us to pay for the property and then provide us with income during our retirement.

Building Cash Flow and Profits in Belize

Besides the cost of land, we expect to spend roughly $350,000 to build, furnish, and landscape the properties. Our anticipated total cash investment will be roughly $500,000 for each property. We are raising those funds through a combination of sources:

1. I leveraged assets that I own in California to raise some money for my investment in Costa Rica.

2. I brought in other investors and they joined me in making the acquisition.

3. I negotiated a great deal with the developer to finance me on the property.

4. I expect to borrow a total of $500,000 to fully fund the development of each property, and I anticipate that I will keep at least $50,000 of those funds on reserve for unanticipated emergencies.

5. My monthly payment on a $500,000 note, financed at a 6% interest rate, over 15 years, will amount to $4,220.

6. I expect to finish construction on both houses in the year 2023.

7. In addition to furnishing each property, I will also provide an economical vehicle that I will make available to guests.

8. I will provide a job to a local Belizean, tasking that individual with cleaning and maintaining the property daily. I expect to pay a total of $500 each month for this service.

9. I will list the three-bedroom, three-bathroom, pool property on the Airbnb website. On average, I expect to earn an average daily fee of $250 for use of the house and car, with a four-day minimum rental fee.

10. Allowing for vacancies, I expect the property to generate a conservative income of, on average, $5,000 per month, or $60,000 per year.

11. After 10 years, those revenues will have decreased my debt on each property. By 2033, I expect to owe less than $220,000 on each house.

12. I anticipate that the property will be worth $650,000 the day I finish construction. I base that estimate on the fact that the developer will be selling lots in that subdivision for $250,000 in 2023.

13. Anticipating that the property will appreciate an average of 4% each year, the property should reach the following valuations:

a. 2023: $650,000

b. 2024: $676,000

c. 2025: $703,000

d. 2026: $731,161

e. 2027: $760,400

f. 2028: $790,824

g. 2029: $822,457

h. 2030: $855,355

i. 2031: $889,569

j. 2032: $925,152

k. 2033: $962,158

14. If I sell the property in 2033 for $962,158, as projected, I will use those funds to pay off the balance of debt that I have on the property: $220,000. This will leave me with a profit of roughly $700,000 after closing costs.

That is my back-of-the-envelope projection on how I will manage the property at The Reserve in Belize for income and profit. Obviously, no one can predict the future. But when I make an investment, I consider potential for upside and risk to

If you would like to discuss, please connect to leave me your comments.

7. How You Can Invest To Earn High ROI

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

What kind of investor are you?

I started thinking about how to answer that question in early 2018. At the time, my wife and I owned several properties in California. The cumulative valuation of those income properties ranged between $3.2 and $3.5 million. We were pleased to control the assets, especially because we could rely upon the income they generated to pay down the debt we used to acquire the assets.

But owning income-producing properties wasn’t the only type of investment available to us. In 2018, I realized that I would need to change my investment strategy.

Investing Outside the US

I decided to begin looking outside of the United States for a number of reasons, including the following:

- Political turmoil in the United States posed a threat to the U.S. economy, from my perspective. Leaders of our country kept pouring on massive amounts of debt. We could service those debt levels as long as our economy kept expanding. But if the economy were to slow, those debt levels could prove problematic. Inflation levels could rise. Interest rates could rise. The cyclical nature of our economy suggested that it made sense to look plant some assets outside

fo the United States. - Major index averages have been rising for several years. At the lowest point of the recession, the

Down Jones Industrial Average was trading at less than 7,000 points. In 2018, those levels surgedpassed 26,000 points. Volatility in the stock market concerned me, especially since my wife and I were in ourmid 50s . If there was a major market correction, I didn’t want to be waiting around for a recovery that could require several years. - The income properties that I owned in the United States kept me rather busy, and I didn’t want to take on any more properties at 2018 valuations. Although the properties I owned were performing, the economics would not be as favorable with new acquisitions.

The three reasons above convinced me that I should look elsewhere. As stated in the article below, first I went to Belize, then to Costa Rica:

Besides income-producing properties, I found investments that could result in significant capital appreciation. Indeed, I anticipate the equity investment I made in Costa Rica will result in more than a 5x return on capital.

Individuals who are looking to invest overseas are in a strong position. Some options include:

- Purchasing home sites and building an income property on the land

- Purchasing a land and building a commercial property

- Offering capital to the developer at a

fixed-rate of return - Investing capital to obtain a piece of equity in new development projects

The right decision will depend upon each individual’s investment objective.

I use every strategy to work toward financial prosperity. Shouldn’t you do the same?

8. How You Can Make Money By Investing At the Reserve

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

When making any type of investment, it’s important to think about how you can make money 7 by investing. As I’ve written in the free book that you can download from the link below, I’m a self-taught investor:

For clarity, I’m neither a financial advisor, a licensed securities broker, or a lawyer. Instead, I’m a guy who made a lot of bad decisions as a young man. Those bad decisions had consequences. As a result, I had to teach myself how to overcome challenges. Learning how to invest helped me through the journey. If you want to learn how you can make money by investing, you may want to study the same books I used to learn.

In the beginning, I learned about the stock market. While in prison, I could watch CNBC and learn from the way that other people invested in the market. Each day, the financial journalists would interview company leaders. I’d listen learn as the executives spoke about strategies their companies were pursuing to gain market share and increase value for shareholders.

Besides corporate executives, the journalists interviewed analysts from different sectors. Some of those analysts spoke about technical analysis, where they would study how the stocks performed over a given period of time. Others would talk about fundamental analysis, where they would assess metrics of corporate performance, like price-to-earnings multiples, growth rates, profit margins, market capitalization, and so forth.

Besides CNBC, I read scores of books, newspapers, and magazines about investing. I learned many lessons from studying the market. And as I describe in the book above, those lessons helped me earn hundreds of thousands of dollars from speculating in stocks. After authorities released me, I decided that real estate would be the best vehicle for me to build prosperity.

Stock Market and Real Estate

Lessons I learned from the stock market helped me to become a better investor.

You can choose how you want to invest. You can make money by speculating in stocks or different financial instruments. But you can also lose money by investing in stocks or other financial instruments.

With real estate, you can make money, too. As long as you can hold the asset, the real estate will always have value. And if we look at historical valuations, over time, the real estate will increase in value.

I made money by using leverage to invest in real estate. With little to no-money down, I began to acquire real estate. In the beginning, I used debt to acquire single-family houses. Once I owned the houses, I found tenants to rent the houses from me. Each month, those tenants would pay rent and I would use the rent to make mortgage payments or service debt I took on from other investors. As I built a track record of owning real estate, I was able raise more capital to acquire more real estate. When markets changed, however, I switched to investing in land.

Investing in land can be a great investment. Especially if your land investment has the following characteristics:

- You can acquire the land with little to no-money down.

- You have the resources to cover the monthly payments on the land.

- Other investors are investing in land around the land you’re acquiring.

- You can spot a trend of the land increasing in value.

- Your land investment is located in a market with appreciating valuations.

I never ask anyone to do anything that I’m not doing. Between 2012 and 2018, I made several real estate acquisitions in California. But in 2018 I began investing in foreign markets, buying land or equity in land developments. I intend to make money from those investments because they satisfy each of the five characteristics that I list above.

You can decide whether it makes sense to invest in stocks, bonds, income properties, land investments, or some other vehicle.

Either way, make a decision and invest! Because if you learn how, you can make money with investments. But if you don’t invest, you can’t participate in the upside.

9. Reasons To Invest Outside The USA

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

To conquer the struggle of living in prison for multiple decades, I had to build the strongest mindset possible. I learned that I could build a stronger mindset by looking ahead and preparing. By reading every day, I could strengthen my mind and my outlook on life. From reading, I learned how to build confidence and self-esteem, and I believed that I had the power within to change circumstances in my future.

Seven Years of Feast Followed by Seven Years of Famine

One book that I read repeatedly was the Bible. I always remember a Biblical passage from the Book of Genesis that prophesied seven years of plenty which would be followed by seven years of famine. That story convinced me to look ahead and to prepare constantly for what could come in the future.

Like many Americans, I feel as though I live in the greatest country on earth. We have amazing abundance in the United States. Despite all of our many blessings and abundance, we cannot dismiss the possibility of a financial reversal. Our economy moves in cycles, and since the great recession, we’ve been growing immensely.

I concluded my prison term in August of 2013. The Dow Jones Industrial Average traded at 15,112 points. A CNBC article from Thursday, August 15, 2013, shows the pessimism that existed then.

Since then, we’ve enjoyed an amazing recovery. Five years after that dismal report from August of 2013, in August of 2018, the Dow Jones Industrial Average traded at more than 26,000 points. That gain of more than 11,000 points represents a rise of more than 70% over five years.

Is it likely that we will see that same rise over the next five years? It’s possible, of course. But if we did, the Dow Jones Industrial Average would be at 45,000 points in five years!

From my perspective, we should recognize the possibility of a market correction and prepare ourselves appropriately. That’s one reason I’m investing outside of the USA.

Investing in Real Estate Rather than Stocks

Rather than investing in the stock market when I got out of prison, I started to invest in California real estate. And like the stock market surge, real estate values grew incredibly during that five years span. My portfolio of assets grew to more than $5 million and my equity in those properties approached $2 million. The assets were kicking off a revenue stream of more than $35,000 each month-which allowed me to maintain the assets.

But would the U.S. economy continue to grow at such levels?

In good times, it’s easy to grow comfortably numb. Yet the experience of living in prison convinces me that in times of peace, we always should prepare for times of struggle. That’s the reason I changed my investment strategy at the start of 2018. Rather than investing in the USA, I’m investing more to own hard assets outside of the United States.

Every individual must make his or her own investment decisions. And if that individual doesn’t have the skill set, the person should consult trusted advisors. When consulting with those advisors, however, think through the person’s motivation. A stockbroker at a big brokerage house will earn commissions based on several factors, including the value of assets under management. If your broker oversees $1 million worth of your assets, his pool of assets under management looks much better than if you were to divert a portion of your portfolio into different asset classes.

Think about strengths and weaknesses, and then make the best decision for you and your family.

Below I list seven reasons that I am investing outside of the United States:

- We have too much political turmoil in the United States.

- Political turmoil can lead to economy policy shifts, which can disrupt investments.

- The stock market has been on a steady climb since the lows of the recession and a correction in the stock market could hurt all investments.

- The US housing market has reached such heights that it is difficult for working-class families to purchase a home.

- Technology is making it easier to manage assets outside of the United States, which may lead to more outflows of capital by ordinary investors.

- Thousands from the baby boomer generation are inclined to live as expats, in countries where their fixed income dollars will provide a higher standard of living at a lower cost.

- Investing in land outside of the USA will always have value, even in times of famine.

10. How To Build A House At The Reserve In Belize

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

You may want to know how to build a house at The Reserve in Belize. Let me reveal my expectations.

My investment at The Reserve in Belize differs from many of the people who purchased more than 1,000 home sites before me. My understanding is that most of those people purchased home sites because they wanted:

- To build a house at The Reserve for their retirement.

- To build a house at The Reserve to enjoy as a vacation property.

- To build a house at The Reserve to use as an income property.

Those were three good reasons. Yet my time horizon for the investment and my ultimate goal differed. My wife and I were in our mid-50s when we made our investment. We wanted to begin investing outside of the United States, and we chose to invest in Belize because we believed that our investment would generate an excellent rate of return while simultaneously protect us from losing value. With so many others investing in Belize, we felt confident that the value of our land would rise over time.

I leveraged other assets that I own to acquire 27 home sites in a pre-construction area of the Laguna Palms subdivision. When I made the acquisition, my intention was to sell 25 of the home sites and build houses on two of the lots. We would not begin to build until 2023, when we anticipated some of our other investments to mature. Since we did not expect to build until 2023, I invested in home sites that I expected to become more valuable over the next five years.

We intended to use those two houses as income-producing properties. To prepare for the build, I interviewed Frank Connelly, CEO of Newport Land Group. If you’d like, you may watch that interview on my YouTube channel at the following link:

- Interview with Frank Connelly on How to Build Houses at the Reserve, see YouTube channel

As I understood Frank, the process to build at The Reserve follows:

- Purchase a piece of property.

- Retain an architect to draw up the plans and a contractor to build the house.

- Submit the plans to the planning-review board at The Reserve and get approval to build the house from the planning-review board.

- Submit the approved plans to the building authorities in Belize and obtain approval.

- Obtain the building permits from the central building authority in Belize.

- Clear the property and begin to build.

- Expect the entire process to take approximately one year.

Investment Plan:

My intentions are to build the first house in 2022 and to build the second house in 2023. I will use those two properties to generate income as short-term rental properties through the Airbnb service. I will retain local help to manage the property and I will use technology like smart keys and cameras to keep an eye on it.

I am budgeting a total investment of $500,000 for each property in this gated, oceanfront community. I expect to invest approximately $150 per square foot, all in, to build and landscape each property. My budget will leave sufficient capital to fully furnish each house. For my purposes, a house of 2,000 square-feet will provide sufficient space to generate $60,000 in annual income. If I borrow $500,000 at a 6% interest rate to fund the property, and I finance the note on a 15-year plan, my monthly payments will approximate $4,200 per month; if I were to finance over a 30-year plan, my monthly payments would be less than $3,000 per month. Either way, I would have sufficient cash flow to pay for the property and I would not have one penny of my own money invested.

Further, once the property is complete, I anticipate that it would be far more valuable than the $500,000 it cost me to build. Indeed, I am anticipating that by 2030, the value of each property would be worth close to $1 million. For those reasons, building a house at The Reserve strikes me as an excellent alternative investment.

11. How To Visit The Reserve In Belize

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

Regardless of where you live in the United States, it’s easy to get to Belize. I can tell you how I got to the property from Orange County, California.

Step 1:

- I boarded a flight from John Wayne International Airport to the airport in Houston.

Step 2:

- I transferred planes to board a flight from Houston International Airport to Belize City.

Step 3:

- I boarded a puddle-jumper flight in Belize City and flew about 20 minutes to the airstrip at The Reserve, in the Stann Creek District of Belize.

Although the airport that is nearest to your city may not fly to Belize City, it’s easy to catch a connecting flight at many major U.S. Cities. My research showed the following major U.S. cities with direct flights to Belize:

- Los Angeles

- Houston

- Atlanta

- Miami

- Chicago

Once you land in Belize City, puddle-jumper flights on Mayan Airlines can take you to the airstrip at The Reserve. Or some people may want to rent a car and drive south to the property.

As I recall, the flight from Houston to Belize City lasted about two hours. The distance may be closer to fly from Miami, Atlanta, or New Orleans.

Either way, it’s easy to travel to The Reserve in Belize.

12. What Amenities Exist At The Reserve In Belize

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

I’m super enthusiastic about the investment I made at The Reserve in Belize. The property is an amazing 14,000 acres that sits on the Caribbean in Southern Belize. As described in an earlier article, I initially traveled to Belize with the intention of diversifying my investment portfolio. You can read that article by clicking the following link:

Once I saw the scope of the entire development, and experienced all of the amenities, I decided to make a much bigger commitment. I leveraged other assets I held to acquire 27 lots in Belize. My investment The Reserve now represents the largest part of my real estate investment portfolio.

The amenities at the development influenced my decision. You can see those amenities by looking at the photographs I publish on this page and through videos I publish on my YouTube channel.

Let me do my best to describe those amenities here:

Caribbean Beach Club:

The beach club includes a beautiful pool and spa, and a white sand beach. Friendly staff offer pool-side service. In the evenings, groups come together for a festive karaoke night, movie night, or dancing. It’s a fun, family-friendly environment, with cabanas and bungalows for guests.

The Reserve Marina

Although The Reserve has many amenities, I like the marina best. The developer carved a channel from the Caribbean into a deep-water basin that can accommodate mega yachts. I derive a lot of enjoyment out of watching the yachts come into the harbor.

The Beach Club Restaurant

The Beach Club features an outdoor restaurant with an excellent menu, serving breakfast, lunch, and dinner.

The Beach Club Bar

It’s always festive at the palapa bar, only foot steps away from the white sand of the Caribbean sea.

The Marina Restaurant

When I visited The Reserve, the restaurant at the marina served a buffet style menu in the open-air restaurant. There was also a live band and dancing for the owners and guests.

The Marina Bar

Adjacent to the marina restaurant is an open-air sports bar where owners and guests gather for good times.

The Private Island

The private island sits about five miles off shore. It’s truly an amazing property, five acres of white-sand and crystal-clear water for diving. Divers see the most amazing colors in the coral reef.

The Equestrian Center

Horse lovers can enjoy the stables and arena, with community horses owners can use to tour the 14,000 acre development.

The Organic Gardens

The organic gardens are one of the highlights of The Reserve, with acres upon acres of produce, seasonings, and flowers.

The Laguna Palms Lagoon

The developer is building a 13-acre, man-made lake in the Laguna Palms section of The Reserve, with anticipated completion by 2023.

The Laguna Palms Beach Club

Once the lake is complete, builders will construct the new beach club on the lake for residents of the Laguna Palms subdivision.

The Fitness Parks

Throughout The Reserve, there is wide open space, some of which has been reserved for fitness parks.

All of those amenities gave me a high level of confidence in The Reserve, which is why I hold the largest allocation of my assets at The Reserve in Belize. Those amenities show that there is a lot of room for upside in my investment.

13. How Does Investing At The Reserve Compare To Investing In Stocks

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

I’m a huge believer in the United States and our economy. And there were times when I felt strongly about investing in stocks. Yet as a man in his mid-50s, I have to think a great deal about what I’ve learned from investing in the stock market. When I consider all factors, I get more enthusiastic about the 27 lots I acquired in Belize.

For those who want more insight into my investment history, I urge you to download my free book:

But let me give you the back story quickly.

Investing in Stocks

After earning my undergraduate degree from Mercer University and master’s degree from Hofstra University while I was serving 26 years in prison, I began studying toward a Ph.D. at The University of Connecticut. A warden blocked the continuation of my studies toward a Ph.D. when I was one year into the program. When the prison system brought an end to my formal education, I turned my attention to the stock market and I began investing.

It was the mid-1990s and the Internet really interested me. Since I couldn’t access computers, I read about how this new technology was evolving. Wanting to participate, I began to acquire small stakes in the leading Internet companies. Those investments started with America Online and Yahoo! As those stocks shot up in value, I used leverage to build bigger positions in those companies. I expanded my holdings to other Internet companies, including Double Click, Real Networks, At-Home Communications, and others leaders into the technology sector.

Those investments helped me to earn more than $1 million. But when the Internet Bubble popped, I lost the majority of those assets.

That lesson taught me a great deal about investing. When I finished my prison sentence and began my new strategy to build prosperity, I chose to invest in real estate rather than stocks.

Investing in Real Estate

Investing in real estate appealed to me for a lot of reasons. Primarily, I could use leverage to acquire a bigger portfolio of assets. As those assets appreciated in value, my net worth would grow in value. I had to be sure of that I could generate a sufficient income to pay for the debt that I had accepted. Yet my research convinced me that my investments would grow in value as the overall economy improved.

Investing at The Reserve

In 2018, I chose to recalibrate my investment strategy. I would stick with real estate, but instead of investing in California, I began investing overseas. Now, my biggest holding is the 27 home sites that I acquired in the Laguna Palms subdivision at The Reserve in Belize.

An investment in Belize differs from the stock market because I own a tangible asset-real estate in a gated, oceanfront community with many amenities. Regardless of what happens to the U.S. economy, real estate in a beautiful community will always have value. And I’m convinced that value grows. People who want to retire in a tropical paradise, with a lower cost of living, will invest in real estate that they can enjoy.

And that is one of the biggest differentiators between real estate at The Reserve in Belize, and a basket of stocks. In Belize, I’m able to enjoy my asset while I’m simultaneously able to watch it grow in value.

That’s why I’m investing in paradise, and I found paradise at The Reserve in Belize!

14. Why I Think Property Will Rise In Value

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

I am not a financial advisor or securities broker, but I am convinced that property values at The Reserve will continue to rise in value. In fact, I feel so strongly about this investment that it now comprises the largest allocation in my portfolio of properties.

Some financial advisors and lawyers may say that my opinions are biased. They’d be right!

But unlike many financial advisors and lawyers, I invested my own money. The 27 home sites that I purchased at The Reserve in Belize represents the largest holding in my investment portfolio. Let me tell you why I am confident that all property at The Reserve will rise in value over the coming decade.

A Rising Tide Lifts All Boats!

Timing is important, and I’m looking at a 15-year plan.

As of right now, investors have purchased more than 1,000 home sites at The Reserve. Those investors authenticate the value of the asset. After all, an asset is only worth what the next person is willing to pay for the asset. Since buyers have acquired more than 1,000 properties from the developer, there is a lot of

But those investors didn’t only purchase a home site. They made the decision to invest hundreds of thousands more to build a house on the property. Some will use their house as an income property, but most will use the house as a vacation home or as their primary residence when they retire. Either way, cumulatively, the investment that owners make to build a house on their property will bring several hundred million dollars into the development. Those investments will boost property values for all.

Besides the individual owners, the developer continues to invest tens of millions of dollars in The Reserve. When I invested in the Laguna Palms subdivision at The Reserve, I anticipated that property values would double over the next several years because of the new man-made lake and beach club that was being built. I’m extremely optimistic that prices will continue to rise. The developer projects that by 2023, when he completes the Laguna Palms subdivision, lot prices will sell for $250,000 each-which will provide a huge return on investment for me.

Continuing investments from owners and the developer give me a high level of confidence that property values at The Reserve will continue to rise. But I’m also optimistic that investors in America will see opportunities to invest overseas as being a safe hedge against volatile stock markets, lower bond yields, and political turmoil in the USA.

Taken together, I’m very bullish on property values at the Reserve in Belize. That’s why I invested heavily, and why I’ll continue to invest!

15. Process To Invest With No-Money Down

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

If you would like to acquire one of the lots that I have in inventory, then you should know the process.

It’s important to note that you will never pay me a dime. Your contract will be directly with Eco-Futures Developers. Among other details, your contract will specify the following terms:

- Lot Number and Location

- Purchase Price

- Financing Terms including

no-money down (only first-payment due with contract) - Interest Rate

- Terms of Loan

- Six-month Rescission period, contingent upon you visiting the property

If this makes sense to you, anticipate the following steps to move forward:

Step 1:

I need you to send me an email with the following information that I can pass along to the developer:

- Today’s Date:

- Your Last Name:

- Your First Name:

- Your Middle Initial:

- Your Date of Birth:

- Your Place of Birth (City / State / Country):

- Your Spouse’s Name (If applicable):

- Your Nationality:

- Your Current Occupation / Nature of Business:

- Optional:

- If there is a second owner, please include same information for other owner)

- Current Contact Information:

- Phone Number 1:

- Phone Number 2:

- Email Address 1:

- Email Address 2:

- Street Address:

- City:

- State or Territory:

- Zip Code:

- Country:

Step 2:

I will pass along your information to the developer and let him know that you would like to acquire a lot with

You will not pay me a dime.

Your contract will be

Step 3:

The developer will send you a contract along with a credit-card authorization form to collect the first payment, as agreed upon in the contract. The lot will then be your property, with a six-month rescission period, contingent upon you visiting the property.

Once you acquire the asset, you can begin to build upon the land.

16. Federal Trade Commission Shuts Down The Reserve

- Attention: Read this article to get more details on the current state of affairs at The Reserve, including the FTC Action against the development team. I’m keeping the information available below for historical reasons. (Updated November 14, 2018)

November 13, 2018

All of the information in steps 1 through 15 are moot as of November 7, 2018. That is the day that I learned I learned of the FTC Civil Action against the development in Belize.

I do not know what will transpire from that FTC action. My focus is on getting a refund for all of the Class A investors that joined me on the project we intended to develop in Costa Rica.

Since the FTC has launched this action against the developers at The Reserve, we know that we cannot move forward with the Costa Rica project. And without the Costa Rica project, I have no further involvement in Belize.

I will publish a full update on this project when attorneys advise me that I can do so. First I will publish on the FTC website, and then here.