Settling with the FTC

Why I Surrendered $5 million in Assets to the Federal Trade CommissionMichael Santos Reports

Annotation:

My name is Michael Santos, and I have a well-documented story of succeeding after many struggles. I made terrible decisions as a young man that led to my serving 26-years in federal prison. A Google search of my name will show the work that I’ve done to reconcile with society and to live as a law-abiding, tax-paying citizen.

Within five years of concluding my prison term, I accumulated approximately $5 million in assets, including $3 million in equity from real estate investments and businesses I helped to create. One of my vocations is publishing or ghostwriting books. I’ve authored more than 15 books, and I often pair writing with consulting. Through businesses I’ve worked to create, I’ve had a role in opening job opportunities for more than one-hundred people and generating millions of dollars in taxes.

In 2018, my wife and I made a bad real estate investment. That investment resulted in the Federal Trade Commission adding me to a civil lawsuit it filed against Sanctuary Belize and others.

- I was not a principal of the company,

- I did not have any authority or decision-making power over anyone that worked for the company, and

- I made a good-faith investment of $1.4 million of my own money to become a limited partner in a new development.

When I sued to recover my $1.4 million investment, the FTC retaliated by amending its complaint to add me as a defendant in the lawsuit against Sanctuary Belize. That lawsuit exposed me to $140 million in civil liability–threatening to cripple my career. The FTC exploited my history of imprisonment and mischaracterized my role.

To avoid a potential judgment of $140 million, I agreed to settle the FTC’s civil charges, “without admitting or denying liability.” I made a calculated decision. My history of imprisonment would make it difficult for me to prevail. I could recover by building new entities. But if I had a $140 million judgment against me, the challenge would be more daunting.

To prevail, the FTC would have a minimum legal threshold. The agency would exploit my past by saying I either “knew or should have known” about violations of FTC rules. A judge could hold me liable and decimate my future career in business.

We have to live in the world as it exists, rather than as we would like it to be. I made disastrous decisions when I was 20. I went to prison. As a result, my past will always make me vulnerable to litigation. These are the collateral consequences of mass incarceration.

This document provides the chronology of events that led to my problems with the FTC. I’ll amend this document from time to time while I complete a digital book that I’ll make available for anyone that has an interest.

It’s part of my ongoing effort to rebound from recent struggles, with my dignity intact.

Struggles or difficulties can strike anyone at any time. Through my work, I strive to show others how to be resilient. I never ask anyone to do anything that I’m not doing, and I’ll continue to document this story, providing links to supporting documentation. With digital publishing, we can use self-advocacy to recover from unanticipated challenges.

Contact our team if you’re facing challenges. You may need a strategy to launch the next phase of your career. Take preventative measures in anticipation of unexpected problems. One fact in life is that struggles and problems will surface. We must all work toward being resilient.

Michael@ResilientDigitalPublishing.com

Chronology of Events

Settlement with the Federal Trade Commission

On January 14, 2020, a federal judge signed a “Stipulated Order” that finalized a settlement agreement in a civil matter brought against me by the Federal Trade Commission. I’m distributing this Order voluntarily to anyone that has an interest in my work and as an obligation to people with whom I do business. The Order includes provisions that may have a bearing on our working relationship.

I will also publish this information, and supporting documentation, on my websites at:

In the interest of full disclosure and compliance with the Order, I declare under penalty of perjury, under the laws of the United States of America, the information I provide is true and correct. To validate, I provide links to supporting documentation.

History

Chronology:

On July 31, 2018, my wife and I provided a cashier’s check to Newport Land Group for $1.4 million[1]. As stated on the cashier’s check, we earmarked our investment to become limited investors in a real estate project that Newport Land Group intended to develop on the Pacific Ocean, in Costa Rica.

In addition to our personal investment, I invited several family members and friends to join us. In total, our group contributed $3.35 million to become limited investors in the Costa Rica real estate project through Newport Land Group.[2]

[1] Click here to see copy of cashier’s check we provided to Newport Land Group for our investment in Rancho Del Mar, Costa Rica.

[2] Click here to read testimonial letters filed with the FTC from all investors that joined our investment in Costa Rica.

Lawsuit

In November of 2018, the Federal Trade Commission (FTC) sued Andris Pukke, Rod Kazazi, Frank Costanzo, Brandi Greenfield, and others. Besides being the general partners of Newport Land Group, the defendants were authority figures in the Sanctuary development in Belize. From the time I met Andris in federal prison, he has been a friend.

The lawsuit stemmed from earlier litigation against Ameridebt, a company that Andris Pukke started back in the late 1990s. The FTC sued Andris Pukke and AmeriDebt around 2005. In 2005, I was in my 18th year of confinement, with eight more years to serve. I did not know Andris Pukke, or anything about his development in Belize until I met him in prison when I was serving my 25th year in 2012.

- United States District Court of Maryland, Southern Division

- In re Sanctuary Belize Litigation

- No: 18-CV-3309-PJM

When the FTC sued the general partners in the above-referenced case, it became clear that the real estate project in Costa Rica was not going forward. The $3.35 million invested by other limited partners and me remained in a Bank of America account belonging to Newport Land Group.

To retrieve funds we had intended to invest in the Costa Rica real estate project, all of the limited investors joined together to sue Newport Land Group for breach of contract.[3]

The FTC responded aggressively to our lawsuit against Newport Land Group. The agency believed that the $3.35 million our group intended to invest in the Costa Rica real estate project should become a part of the lawsuit against Andris Pukke and others involved with Sanctuary Belize.

In the FTC’s view, since the authority figures at Newport Land Group were also authority figures with the development project in Belize, any funds those people controlled should become a part of the receivership estate. Authorities cited the mixing of funds. Authorities disregarded the fact that limited investors would not have had any of knowing about any mixture of funds, as we did not control bank accounts.[4]

Amended Complaint

On December 28, 2018, the FTC amended its lawsuit. The amended complaint named Newport Land Group and me as additional defendants in the case. The lawsuit wrongfully accused me of being an authority figure with Sanctuary Belize and its related entities. That lawsuit exposed me to civil liability of $140,000,000.[5]

If I settled, the FTC offered to limit my liability to $86,092,438.67. The agency would not reveal how it came up with that number. My prison term did not conclude until 2013, and the Sanctuary Belize development began operating in 2005 or before. In order to settle, the agency insisted on taking all of my “positive-value assets.”

When the FTC added me to the lawsuit, the Court froze all additional assets my wife and I owned. In addition to the $1.4 million liquid investment we made to join the Costa Rica real estate project, the Court froze our other bank accounts. It froze our additional assets, including our residence and the investment real estate we began acquiring after my release from prison. At the time of the lawsuit, the fair market value of our real estate assets approximated $3.5 million.[6]

One of the assets we owned included a licensed and operating 12-bed senior-living facility, with many residents that were on hospice. The senior-living facility employed more than a dozen people. We began acquiring our portfolio of investment real estate in 2012, as I was concluding my journey of 26 years in prison. Other than $1.4 million we invested as limited partners in the Costa Rica real estate project. None of our assets had anything to do with any of the entities or individuals accused in the original lawsuit against Sanctuary Belize.

- Click here to see the operating agreement for the Costa Rica real estate project.

- Click here to see the subscription agreement for the Costa Rica real estate project.

[3] Click here to see correspondence between my attorney and the FTC regarding the lawsuit that the other investors and I filed in Orange County Superior Court.

[4] See Receiver’s Report to take $3.35 million in liquid assets belonging to investors in Costa Rica project from Newport Land Group.

[5] See the Amended Complaint.

[6] Download financial statement submitted to FTC under penalty of perjury.

Litigation

After burning through more than $250,000 in legal fees, I dismissed the attorneys I had hired to represent me. I chose to proceed without counsel. I attended every deposition and participated actively in the discovery process.

While attending the depositions, I took extensive notes and deposed the witnesses myself.[7] During those deposition proceedings, I had many opportunities to speak with the attorneys representing the FTC. I pointed out how the depositions showed that the FTC attorneys were misrepresenting me as being an authority figure of the Sanctuary Belize development team. Every person that the FTC deposed testified under oath that I did not have any authority role in the company.

The agency’s decision to add me as a defendant in the case, I suggested, was a collateral consequence of mass incarceration.

I had an “off-the-record discussion with the lead FTC attorney. Two other FTC employees were present. During that conversation, I said that the FTC made me a defendant as a result of my prior imprisonment. The FTC attorney said I was wrong. He said the FTC did not make me a defendant in the original lawsuit, and I would never have been a defendant. The FTC added me as a defendant, he said, because I sued Newport Land Group to recover the $1.4 million my wife and I invested in the Costa Rica real estate project. Since our conversation was “off-the-record,” he made it clear that I could not cite his words in Court. In the interest of truth, I trust that he does not object to me writing the essence of that conversation to clarify the record.

When I told the FTC attorney that I filed that lawsuit against Newport Land Group on the advice of counsel, he advised that I should sue the attorney for malpractice. Yet several attorneys agreed that the only approach to recovering my investment was to sue Newport Land Group.

At every stage in the proceeding, I acted in good faith. I made an overture to walk away from the $1.4 million I invested if the agency would return funds to the other Class A investors. The FTC rejected the offer, saying that the Court had already ordered that funds we invested in the Costa Rica project had become a part of the receivership.

Later, I offered $600,000 in additional liquidity if the FTC would allow me to retain the investment real estate my wife and I had acquired in California. The FTC rejected the offer, demanding that I contribute an additional $1,047,000 to the receivership if I wanted to retain our properties.

Based on the abundance of evidence gathered to show that:

- I did not have any decision-making authority with the developer,

- I did not set policies for the developer,

- I did not share in profits or receive commissions, and that

- I did not have any reason to believe the company was not 100 percent legitimate,

I prepared an extensive motion for summary judgment. I hoped that the judge would dismiss me from the case because I was a limited investor and also a W-2 employee for the developer, but not a person with any decision-making authority for the development team.[8]

I believed that I could prevail in a trial. Yet several attorneys that knew the case well helped me understand the risk of litigation. Since the matter was civil in nature, the FTC had a very low threshold to hold me liable.

If I went to trial, attorneys for the FTC would exploit my history of imprisonment, my friendship with Andris Pukke, and the fact that I worked for the developer after my release from prison. They would argue that I “should have known” about violations of FTC rules, and that could be sufficient to hold me liable for $140 million.

Andris Pukke, the developer, is a friend of mine. He offered to assist me as I adjusted in society after 26 years in prison. He offered me employment and tasked me with assignments to help the company. Since I believed the company was 100 percent legitimate, I willingly complied. During my first few months of employment with the company, I authored a booklet called “The Buyer’s Guide.” Although the Buyer’s Guide did not make a single misrepresentation, the FTC accused me of writing the Buyer’s Guide to help sales, which could make me liable for the judgment.

My history of being in prison, and my friendship with Andris, exposed me to enormous financial risk. Further, I filmed a series of videos to document my investment decisions. All of these efforts were part of a plan to build a new venture around my journey.

The FTC mischaracterized the videos I created. Each video was part of my efforts to build Alternative Investment Properties and document my investment journey. The FTC accused me of filming videos to assist with the developer’s sales.[9]

To hold me liable for $140 million, the FTC would only have to show that I either “knew or should have known” that authority figures in the development company had violated FTC rules. It did not matter that:

- I never earned a single commission,

- I never received a profit distribution,

- I never oversaw a profit and loss statement,

- Not a single employee reported to me,

- I was not a signer on a single corporate bank account for the developer.

- I invested $1.4 million to become a limited investor,

- I invited family and friends to join me as a limited investor.

If the FTC prevailed, I would have a judgment of $140,000,000 against me. A nine-figure judgment would be an insurmountable barrier to my career. Since I intended to work toward making other investors whole, I could not take that risk.

[7] Click here to review notes from all deponents.

[8] Click to review Summary Judgment Motion that I filed in federal court.

[9] See Exhibit List for Summary Judgment, with info on Alternative Investment Properties.

Settlement

As a result of the enormous risk that the attorneys described, I stipulated to a settlement agreement with the FTC. That settlement agreement did not require me “to admit or deny any of the allegations in the Complaint.” Nevertheless, the settlement required that I accept burdensome terms, including:

- Monetary judgment of $86,092,438.67.

- Forego all my frozen funds or assets, including:

- $1.4 million I invested toward the Costa Rica real estate project,

- $24,528.93 in frozen cash accounts,

- $900,000 Coastal Way Property,

- $1,300,000 Birch Hill Property,

- $650,000 Lindberg Property,

- $250,000 Falling Leaf Property,

- $350,000 Chase Avenue Property, and

- $50,000 Miscellaneous Business Investment

- Total Assets: $4,874,528.93

In exchange for walking away from $4,874,528.93 in assets, with approximately $3,000,000 in equity, the FTC agreed to suspend the remainder of the $86 million judgment against me.

California is a community-property state. Despite not being a party to the lawsuit, my wife is also subject to the financial terms of the settlement.

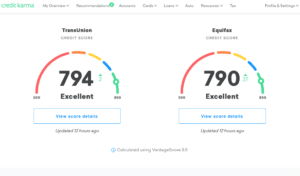

At the time we controlled our properties, my wife and I maintained excellent credit. We had mortgage debt of approximately $1.7 million and we paid those mortgages on time. With the settlement, however, we no longer control the properties we once owned together. We do not expect the Receiver representing the FTC to pay the mortgages on time. Accordingly, both of us anticipate damaged credit as a result of this settlement.[10]

The settlement means I can go on with my business career—provided that I abide by specific permanent injunctions, including the two that follow:

[10] Image of my excellent score on Credit Karma, prior to settlement.

Permanent Injunction

In addition to surrendering approximately $5 million in assets that I accumulated since my release from prison, with $3 million in equity, I must also abide by specific injunctions, including:

- I cannot own any real estate that includes more than two separate units.

- I cannot participate in (or assist others that participate in) any business that helps consumers with any debt relief product or service.

- I cannot make any misrepresentations in business.

- I must also keep the FTC apprised of any business that I launch or oversee.

- Click this Link to See Copy of Settlement Order Here

If the FTC accuses me of violating any of those terms, the agency has the right to lift the suspension and move to collect the remainder of the $86 million judgment against me. That suspension of judgment would expose me to further civil litigation and require me to surrender any additional assets that I’ve accumulated since January of 2019 when the FTC added me to the lawsuit.

In the interest of transparency and disclosure, I am publishing a copy of the Stipulated Order for Permanent Injunction and Monetary Judgment that Judge Peter J. Messitte signed on January 14, 2020.

As mentioned earlier, I will publish a copy of this order and the supporting documentation on my websites for all to see. I will also release a digital book describing:

- How I became involved in this investment opportunity,

- How the 26 years I served in prison influenced perceptions and exposed me to liability,

- What I learned from this process,

- How I intend to rebuild my life after this new challenge.

To comply with section XIV “Order Acknowledgement,” sections B and C, I’m providing a copy of this abbreviated letter to everyone with whom I have a business relationship.

I made every decision in good faith, with hopes of building a family business. My 26-year history of imprisonment, however, continues to complicate my life. Now I must overcome this new hurdle. I intend to do so with my dignity intact, consistent with my message that I never ask anyone to do anything that I’m not doing.

Through Resilient-Digital-Publishing, a new company, I will document every step of the way. As I advanced through prison, I will also move through this hurdle with my dignity intact, and with a 100% commitment to transparency.

Sincerely,

Michael Santos

Complying with Receiver

In addition to surrendering approximately $5 million in assets, the settlement also requires that I cooperate fully with the Receiver. In other words, I must help the Receiver take possession of properties that my wife and I worked hard to accumulate since my release from prison.

Upon receiving the request, I prepared a detailed list of my assets for the Receiver, and I await further proceedings.

This chronology was last updated on Sunday, February 16, 2020. I will continue to make updates as more news becomes available.

All of these efforts reflect a commitment to truth and transparency. I’ve learned a great deal from this process. Through these lessons, I will assist others with strategies to rebound from a struggle. Visit my newest venture to learn more:

Those who want more information may contact me through Resilient Digital Publishing. I’m creating this venture to document the journey, but also to provide services for others that want to work toward emerging successfully after struggle:

Michael@ResilientDigitalPublishing.com

Call or text: 415-419-1728